Carnê Casas Bahia: A Convenient Payment Option for Brazilian Shoppers

Por um escritor misterioso

publicado em outubro/30/2024

/cdn.vox-cdn.com/uploads/chorus_image/image/72140393/1250526549.0.jpg)

Learn more about the carnê casas bahia , a popular payment option provided by one of Brazil's largest retail chains, that offers convenience and flexibility to customers.

One of the main advantages of using the carnê casas bahia is that it allows customers to buy products even if they don't have the full amount upfront. Instead of paying the entire price at once, customers can choose to divide the total cost into smaller monthly installments. This feature makes it possible for individuals with limited budgets to purchase expensive items without straining their finances.

To use the carnê casas bahia, customers need to visit a Casas Bahia store or website and select the desired items. Once they have chosen their products, they can proceed to apply for the Carnê payment option. The application process is usually straightforward and requires basic personal information such as name, address, and identification documents.

After the application is submitted and approved, customers are given a carnê casas bahia card or voucher. This card contains all the necessary information about the purchase, including the total cost, number of installments, and due dates. Customers can then start making their monthly payments either by visiting a Casas Bahia store or through online banking.

One of the reasons why many Brazilians prefer the carnê casas bahia is the flexibility it offers in terms of payment terms. Depending on the product and its price, customers can choose to pay in installments over a few months or even several years. This flexibility makes it easier for individuals with different financial situations to make purchases according to their own preferences.

Furthermore, the carnê casas bahia also provides customers with the option to skip a monthly payment. This can be particularly helpful during unexpected financial difficulties or when facing temporary cash flow issues. However, it's important to note that skipping a payment usually comes with additional fees or interest charges, so customers should carefully consider this option before making a decision.

Another advantage of using the carnê casas bahia is that it doesn't require a credit check. Unlike traditional credit cards or financing options, the Carnê payment method is available to almost everyone, regardless of their credit history. This makes it an attractive option for individuals who may have difficulty getting approved for other forms of credit.

It's important to mention that while the carnê casas bahia can be a convenient payment option, customers should be aware of the potential drawbacks. One of the main disadvantages is that interest rates associated with this payment method tend to be higher than those offered by traditional banks or credit card companies. As a result, customers may end up paying more in interest charges over time.

In conclusion, the carnê casas bahia is a popular payment option provided by one of Brazil's largest retail chains. It allows customers to make purchases and pay for them in installments over a specified period. This payment method offers convenience and flexibility, making it accessible to individuals with different financial situations. However, customers should carefully consider the interest rates and potential fees associated with this payment option before making a decision.

EN VIVO: Real Madrid vs. Celta de Vigo online, Liga Santander - Fútbol Internacional - Deportes

Celta - Real Madrid: horario y dónde ver hoy por TV el partido de la tercera jornada de LaLiga EA Sports

In Brazil, the carnê casas bahia is a payment option offered by one of the country's largest retail chains. Casas Bahia is well-known for selling a wide range of products, including furniture, electronics, appliances, and more. The carnê casas bahia allows customers to make purchases and pay for them in installments over a specified period. This payment method has become quite popular among Brazilian shoppers due to its convenience and flexibility.One of the main advantages of using the carnê casas bahia is that it allows customers to buy products even if they don't have the full amount upfront. Instead of paying the entire price at once, customers can choose to divide the total cost into smaller monthly installments. This feature makes it possible for individuals with limited budgets to purchase expensive items without straining their finances.

To use the carnê casas bahia, customers need to visit a Casas Bahia store or website and select the desired items. Once they have chosen their products, they can proceed to apply for the Carnê payment option. The application process is usually straightforward and requires basic personal information such as name, address, and identification documents.

After the application is submitted and approved, customers are given a carnê casas bahia card or voucher. This card contains all the necessary information about the purchase, including the total cost, number of installments, and due dates. Customers can then start making their monthly payments either by visiting a Casas Bahia store or through online banking.

One of the reasons why many Brazilians prefer the carnê casas bahia is the flexibility it offers in terms of payment terms. Depending on the product and its price, customers can choose to pay in installments over a few months or even several years. This flexibility makes it easier for individuals with different financial situations to make purchases according to their own preferences.

Furthermore, the carnê casas bahia also provides customers with the option to skip a monthly payment. This can be particularly helpful during unexpected financial difficulties or when facing temporary cash flow issues. However, it's important to note that skipping a payment usually comes with additional fees or interest charges, so customers should carefully consider this option before making a decision.

Another advantage of using the carnê casas bahia is that it doesn't require a credit check. Unlike traditional credit cards or financing options, the Carnê payment method is available to almost everyone, regardless of their credit history. This makes it an attractive option for individuals who may have difficulty getting approved for other forms of credit.

It's important to mention that while the carnê casas bahia can be a convenient payment option, customers should be aware of the potential drawbacks. One of the main disadvantages is that interest rates associated with this payment method tend to be higher than those offered by traditional banks or credit card companies. As a result, customers may end up paying more in interest charges over time.

In conclusion, the carnê casas bahia is a popular payment option provided by one of Brazil's largest retail chains. It allows customers to make purchases and pay for them in installments over a specified period. This payment method offers convenience and flexibility, making it accessible to individuals with different financial situations. However, customers should carefully consider the interest rates and potential fees associated with this payment option before making a decision.

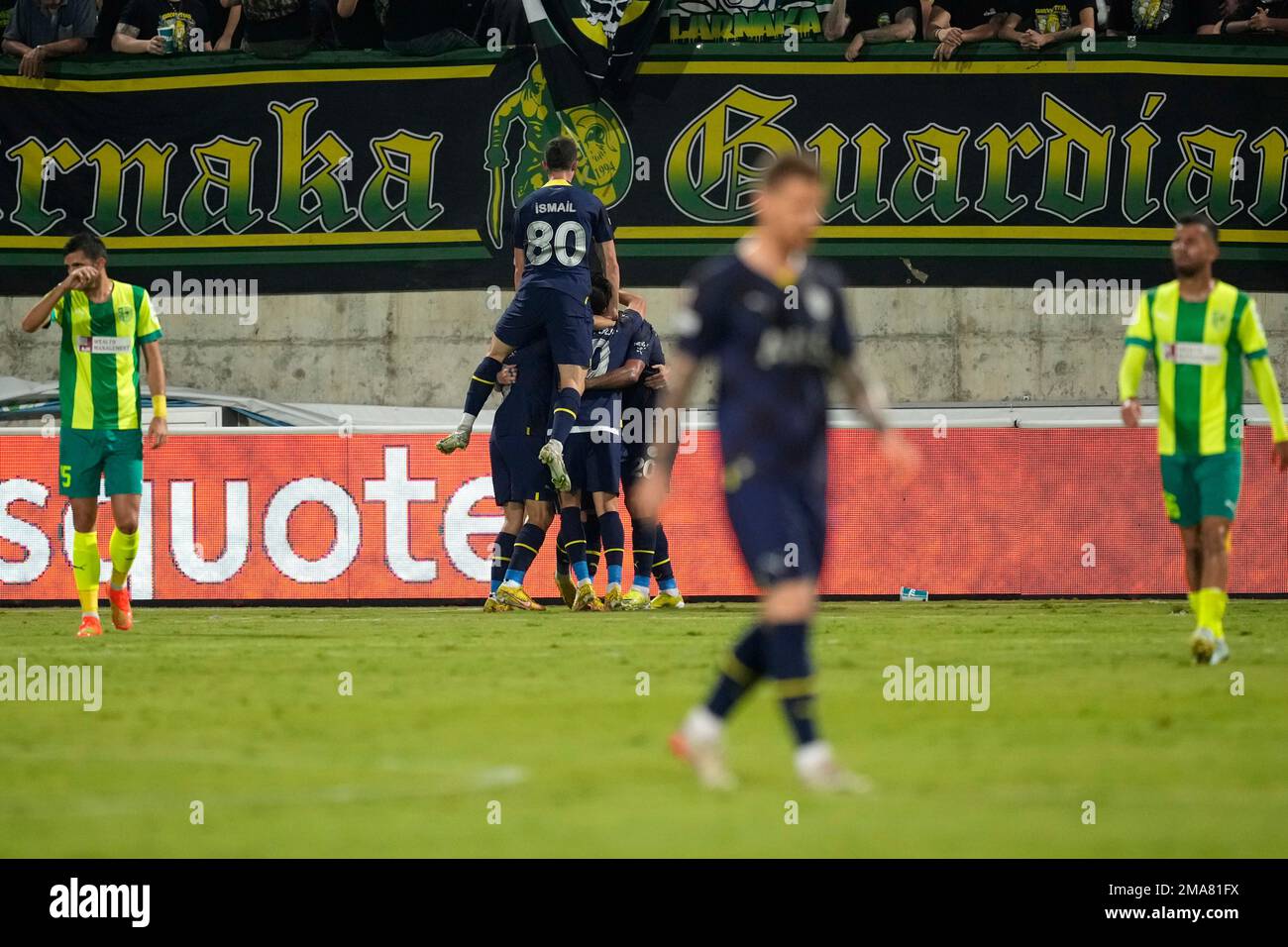

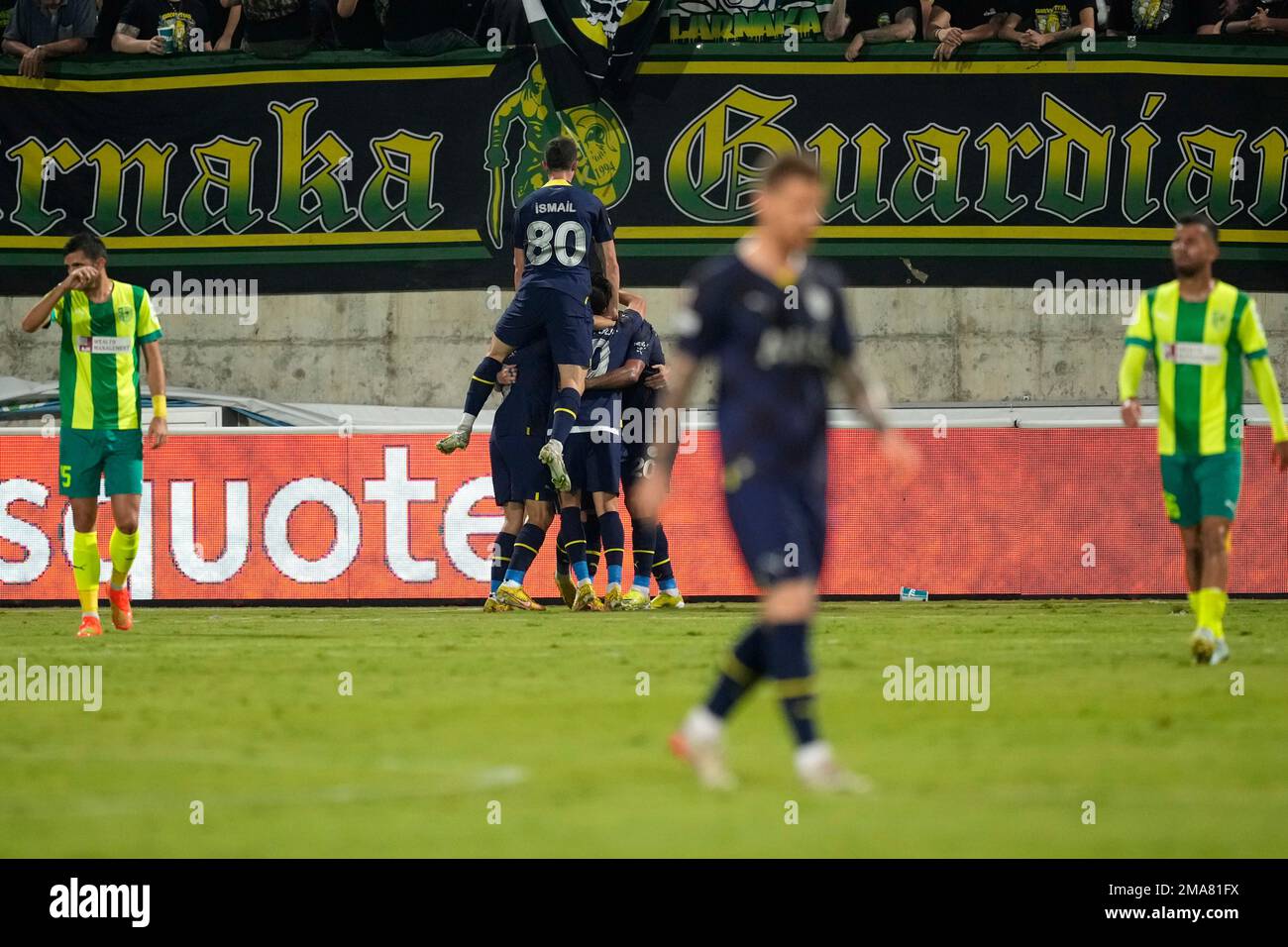

Fenerbahce players celebrate a goal from their teammate Joao Pedro after scoring against AEK during the Europa League group B soccer match between AEK and Fenerbahce at AEK arena stadium in Larnaca

Forno de micro ondas electrolux meus favoritos mef41 31l